What do Baltic NT promoters dream about?

Monika POŠKAITYTĖ

In 2007, when the future of the Baltic countries didn’t look resplendent in gold, but it was at least pink, I met a 22 year old Swede on a plane to Vilnius. The fourth-year student was flying to Lithuania, hoping to become a millionaire in a few years – an investment in the Lithuanian economy, then growing at an incredible pace, and in real estate in the Baltic countries, seemed like a gold mine to him, where you do not even need to dig. And he was not the only one to think this way. Hopefully, this young man did not buy the real estate that was supposed to turn into mountains of gold ...

Today, now that we know how the Baltic Tigers’ history ended, we can see his flight across the Baltic Sea from prosperous Sweden to Lithuania as a folly. However, were those who as recently as in the crisis of 2008, seeing the terrific fast growth of profitability of investments, thought it was the result of a new model of the world economy, rather than an investment bubble, equally foolish? And what to think about those who were too lazy to even look deeper into the fluctuations of the gold price during this century, and believed that even though the price was reaching record highs, it would continue to grow? The gold rush fever got its name specifically because it is based on hope rather than logic; the belief that if others succeeded in easily making their fortune, I will succeed, too.

Therefore, when a bubble is emerging in the market, an increasing number of people begin to believe that this is a real and safe opportunity to earn. It is for these reasons that we should have responsible financial and tax policies that would reduce the potential for bubble formation. Without a doubt, you can’t control all bubbles, because some of them are global, but the most negative influence is usually caused by bubbles formed at home. Therefore, when today's Baltic economies are growing very rapidly in the European Union (EU) and their real estate companies constantly share information in the media about the recovering real estate market, it is a good time to decide whether to take interest of the opportunities of investing in the real estate of the Baltic real estate market, and to check if it is more secure today. Maybe you should wait again for a new bubble?

The Swedish BANG and the Baltic bang-bang-bang

During the last crisis, the burst of the real estate bubble did not come to Sweden for a good reason – the country had already learned its lesson in the most painful way. In the middle of the ninth decade of the last century, construction in Sweden intensified because about 4 per cent of the country's gross domestic product (GDP) was spent for subsidising it. At the same time, loans were becoming cheaper because of inflation, until the experts of Uppsala University finally estimated that the interest had actually become negative because of tax preferences! The last ingredient in the cocktail was aggressive lending, which reached 150 percent of the national GDP because of the loan portfolio.

A great BANG awaited Sweden in the 1990s. In 1990-1995, residential property prices fell by about 25 per cent, commercial properties – by an average of 42 percent, while bad loans rose by 5 percent. Sweden was expected to devaluate the kronor, so the currency market was flooded by a wave of speculation. The Swedish central bank hoped to put them off by increasing the interest rate by 500 percent. But this did not help either: it ended with the nationalization of two banks – Nordbanken and Gotabanken. It cost the country's budget 4 per cent of GDP, or 64 billion Swedish kronor (today, this would amount to about 18.3 billion U.S. dollars). By the way, the Swedish government only sold the last 7 percent stake of former Nordbanken in September this year.

However, the strict actions of the Swedish central bank and politicians have yielded results – the consequences of the bubble burst were eliminated in about seven years. To achieve this, Sweden has adopted many other amendments: nationalised banks could only get government assistance if they agreed to write off bad assets as losses; additional supervisory authority (Bank Support Authority) was established; the regulation of banks was tightened and the kronor was devalued. Then, tax reform was introduced: tax rates for employees were reduced, but the tax base was increased, and capital and dividends were taxed at higher rates. In analyzing the solutions of the crisis, economists note that one of the essential elements of success is the political elite's ability to achieve consensus and structural changes. After the crisis, Sweden could boast of having the most stringent regulation of banks in Europe, and the economist Paul Krugman suggested they should apply the experience in the United States in 2008.

However, in addressing the situation at home with extreme caution, Swedish banks have turned a blind eye to their activities in the Baltic countries, or maybe the emerging economies seemed so attractive that no one wanted to spoil the party with discussions on the lessons learned in Sweden, necessary restrictions and tighter regulation? The truth is, though the small bang-bang-bang of the Baltic States reminded me of the Swedish case, there were many more assumptions made that allowed real estate bubble to form here. According to the analysts, when Scandinavian banks came to the Baltic countries, confidence in these markets increased, so the cost of loans was falling, and foreign investment was growing. Invitation to access the EU contributed to even greater investor confidence. Wages rose, expectations were skyrocketing – the Baltic Tigers seemed unsurpassable. For example, in the decade before the recession, Estonian real estate went up 352 percent! Let’s compare: during the same period, the prices of properties in Germany experienced the slowest growth – just 1 percent.

While real estate prices were rising at a dizzying rate, Lithuania was considering a discussion on the introduction of a real estate tax to reduce the bubble formation rate and prevent it from exploding. It may be hard to believe today, but representatives of the largest real estate companies, in the light of such proposals, recommended looking at the real estate prices in London or Paris. They believed that they had to prove to the public that the real estate prices in Vilnius and Riga still had a great potential to rise. By the way, in trying to understand why politicians and the central banks of the Baltic countries did not take any serious action to stop the formation of the real estate bubble, it is not only necessary to pay attention to the influence of the promoters and intermediaries of real estate projects and the desire to profiteer from the bubble blowing, but also the political investments in real estate, and the influence of the real estate bubble on the economy. The rapid growth of real estate prices has a positive impact on the construction sector and the overall economy growth, so for politicians, it is often much easier to relax and enjoy a fast-growing economy, rather than making unpopular decisions restricting the availability of credit or the attractiveness of real estate investment by increasing the share of tax in the sector. So, the lack of social responsibility among politicians and business, and ignoring the Swedish lessons were the main reasons why the real estate market downturn was so huge.

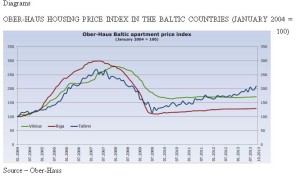

The explosion took place throughout all the Baltic States: the housing price index in the Baltic countries fell by almost half, according to Ober-Haus Valuation and Market Research Department manager, Saulius Vagonis, from the highest price level reached during 2006-2007, to the bottom reached during 2009-2010. In Vilnius, apartment prices fell by about 40 percent, in Tallinn – 50 percent, and in Riga – by as much as 60 percent.

However, to combat the consequences of the downturn, the example of Sweden was used and, according to the manager of the Consultation and Analysis Department at Inreal, Arnoldas Antanavičius, the same errors were not duplicated. "A number of similarities can be seen between the explosions in the Baltic countries and Sweden, but with companies going bankrupt in Sweden, banks rushed to sell the seized property. Under these circumstances, the real estate prices fell further, so not only did the bubble burst, but all the air escaped through the holes. Banks in the Baltic countries created subsidiaries and took over the seized property, but did not rush out to throw it on the market – it is being sold more actively now, when it is obvious that the prices are recovering,” says A. Antanavičius. “In an attempt to get out of the recession, the Baltic countries took a different strategy, and we are already seeing a rise in all the major cities. For example, in Vilnius we already saw the first signs of it last year. So far, regions and smaller towns are still lagging behind, so you can guess that the recovery will be delayed for a year or two there." According to Ober-Haus, since October 2010, apartment prices in Vilnius have risen by 2 percent, in Riga – 11 percent, and in Tallinn – by as much as 35 percent. "It seems that prices are recovering the slowest in Vilnius, but do not forget that it was hit the least", said S. Vagonis.

Both prices and the construction cranes are rising in the Baltic countries

During the downturn, there were almost no new projects, so the Baltic countries are not only now facing the growing expectations of consumers, but also the rapidly growing demand for real estate.

This intensifies the construction sector. The board chairman of the Estonian Merko Ehitus construction company implementing projects in the Baltic countries, Andres Trink, says that the construction sector has been growing over the past two years: "Much of this growth was due to public sector orders. However, bearing in mind that the year 2013 is the last year of the EU funding period, I think that the share of the public sector projects will decline in 2014. However, about half of the Merko Ehitus contracts launched in the Baltics were private orders in 2013. The situation with housing projects in 2013 is probably the best since 2008; the number of projects is growing, but the prices are still about 30 percent lower than the record high in 2007. Thus, rapid growth poses no threat. I would be more critical about office projects – very few new projects have been started recently.” According to A. Trink, the main reason is quite low rental prices, making office projects less attractive.

However, Vilnius is distinguished in the office segment: now, about 13,000 square metres of construction is being completed, over 40,000 square metres of construction is currently pending and another 30,000 square metres of office space has been planned. In 2013, the office space for rent, according to Ober-Haus, amounted to 467,000 square metres, so the supply will increase in the very near future. However, according to real estate experts, the growth should not become a concern: vacant office space in Vilnius is only 8 percent, in Riga, where the total office space area is 679,000 square metres, it is 14 percent, and in Tallinn, where the total area is 579,000 square metres, they have about 9 percent of vacant office space. Thus, the activation of new projects in Vilnius should not come as a surprise. "I would say that the current projects were launched on time, but I think that the future demand will be satisfied for a while", said A. Antanavičius.

Particularly noteworthy is the exclusive real estate market. According to the co-owner of Baltic Sotheby’s International Realty, Paulius Gebrauskas, the market is especially active in Latvia, where in 2010 they passed a law allowing free residence in Latvia and free travel in the Schengen area for everyone who acquired real estate for more than 142,000 euro, and their family: "80 percent of the market buyers in Latvia are foreigners, but they have currently launched a debate on the amendment or withdrawal of this law, or maybe the introduction of quotas. These changes may also affect the real estate situation." According to P. Gebrauskas, exclusive luxury properties are less sensitive to volatility and less dependent on the credit markets: "During downturns, luxury real estate prices dropped by 20-30 percent, but they were the last to fall, and today we can talk about a price level comparable to that before the crisis. However, there were no new projects during the recession, so the market demand currently exceeds the supply."

The last chance to earn or another opportunity to lose?

All of these trends suggest that the real estate market recovery in the Baltic countries is no longer a question, but at the same time it is clear that confidence in the longevity of this process is not high. According to A. Trink, the bubble explosion forced the abandonment of long-term plans – earlier, projects were planned for three to five years, and now it comes to plans for only 6-12 months. This cautious approach is well understandable and is linked not so much with the processes in the Baltic economy, but with external factors of which the real estate project promoters are afraid and which may scare away buyers. This includes the slowing Russia's economic growth, the new wave of problems of the southern EU countries or the Chinese real estate crisis, which is predictable, but has not become a reality.

By the way, when it comes to the effects of free-market factors on real estate prices, with economic growth, and the responsibility of public authorities in mitigating the negative effects, China could be one of the best examples. We should only remember the warnings of prominent economists before the crisis of 2008, that one of the biggest risks to the global economy stems from the Chinese real estate sector. However, no matter how ironic it would be, China's real estate market not only failed to detonate before the recession, but also withstood the crisis. It perfectly supports the assumption that the responsible and prudent policies of the central bank and government decisions may manage the boom in real estate prices, making it similar to the real potential of the purchasing power of the economy and society, and not posing a danger.

Many economists and free market apologists are very critical of all decisions that reduce the value and attractiveness of properties believing it is an unreasonable interference in free market relations and an attempt to regulate prices artificially. These statements have some truth, therefore, when it comes to wise policy, raising prices (the real estate promoters are engaged in it, deliberately encouraging overly positive expectations) or price reduction should not be the goal. Decisions must be made in pursuit of the long-term goals.

For example, if the state is concerned about families and wants to prevent emigration, wants families to live in the country and raise children, with the growing real estate prices, it has to deal with the issue of housing affordability in one way or another. No less important is the choice of the elite in the country, of where to direct the public: towards creativity, or towards the accumulation of capital. It is very easy to identify this by looking at how labour and real estate is taxed. If society is oriented to creativity and increasing personal capacity, income generated from labour and business should be taxed less, and properties should be taxed more. Thus, the focus on the long-term interests of the state is often very clearly a background for certain decisions that do not allow real estate prices to rise above the real purchasing power of the public.

In this context, we have to recognize that, although after the crisis the Baltic countries realised that responsible policy is needed, so far, we can only talk about isolated decisions addressing the most significant problems, but there are no outlines of long-term policy, demonstrating the long-term perspective of real estate prices.

There is no doubt that in the next few years, the real estate market in the Baltic countries will rise and prices will increase, but whether it will be a long-term process that will continue with minimal downs for decades, or a phenomenon reminiscent of American roller coasters, will be shown by the objectives that dominate the agendas of the governments of the Baltic countries and the ways of achieving them. The fact that these objectives had to be set long ago is best demonstrated by the fact that in having a lot of negative influence on long-term real estate values, the demographic situation in the Baltic countries is deteriorating much faster than the purchasing power of the public is growing. So, if there is no wise policy, Parisian real estate prices in the Baltic countries will mean yet another bubble.

Excerpts from the article

There is no doubt that in the next few years, the real estate market in the Baltic countries will rise and prices will increase, but whether it will be a long-term process that will continue with minimal downs for decades, or a phenomenon reminiscent of American roller coasters, will be shown by the objectives that dominate the agendas of the governments of the Baltic countries and the ways of achieving them.

The explosion took place throughout all the Baltic states: the housing price index in the Baltic countries fell by almost half, from the highest price level during 2006-2007, to the bottom reached during 2009-2010. In Vilnius, apartment prices fell by about 40 percent, in Tallinn – 50 percent, and in Riga – by as much as 60 percent.

The rapid growth of real estate prices has a positive impact on the construction sector and the overall economy growth, so for politicians, it is often much easier to relax and enjoy a fast-growing economy, rather than making unpopular decisions restricting the availability of credit or the attractiveness of real estate investment by increasing the share of tax in the sector. So, the lack of social responsibility among politicians and business and ignoring the lessons learned by the Swedish were the main reasons why the real estate market downturn was so huge.

BOX:

ARE THE SCANDINAVIANS PREPARING FOR ANOTHER BUBBLE BURST?

While real estate prices in the Baltic countries are stabilising and rising, Scandinavia is swelling up again – the International Monetary Fund (IMF) in its report released in August, highlights the precarious situation in the real estate market of Scandinavia, especially in Sweden and Norway. It states that Swedish real estate has been overrated by about 25 percent, and the Norwegian by as much as 40 percent. The truth is that they have talked about the potential burst of this bubble for several years, but up to IMF’s report, the banking stress tests have shown that they are capable of absorbing the potential problems of the real estate sector.

The fact that the tension in the Scandinavian real estate sector is seen seriously, and responsible preparations are being made to handle the potential risks, are obviously demonstrated by the decisions being made. Essentially after the end of the crisis of 2008, in particular, in March 2015 they made decisions further increasing the reliability of the bank. Moreover, Swedish Finance Minister, Anders Borg, predicts even greater regulatory tightening. Similar precautions were discussed in Norway. Such attention of responsible institutions on the real estate sector suggests that talking of a possible explosion of the bubble will remain nothing more but talking in the near future.

CONSTRUCTION SCALE AND CHANGES IN THE BALTIC STATES, COMPARED TO LAST YEAR, MILLION EURO/PERCENT

Latvia

Estonia

Lithuania

Full-scale increase compared to the previous year

Source – Merko Ehitus

We deliver, UAB is not responsible for advertisers content or information published graphical material Contacts: +370 (613) 87583, info@wedeliver.lt